Cat health insurance policies are important factors for any owner who wants to give his or her pet cat the best chance at remaining healthy and happy. Like all other pet owners, we want our cats to live happy, healthy, and comfortable lives and to receive the best medical treatment if they become ill or injured. However, veterinary costs are rather steep, particularly when beginning a new treatment for an ailment or cancer diagnosis in the household cat. This is where cat health insurance comes in. Due to the recent increase in the cost of veterinary services, cat health insurance has turned out to be a crucial choice for most people. In this article, readers will discover the various categories of cat health insurance, things to bear in mind when selecting the policy, and how to maximize their choice to allow their cats to benefit from the best plan.

Cat health insurance policies are important factors for any owner who wants to give his or her pet cat the best chance at remaining healthy and happy. Like all other pet owners, we want our cats to live happy, healthy, and comfortable lives and to receive the best medical treatment if they become ill or injured. However, veterinary costs are rather steep, particularly when beginning a new treatment for an ailment or cancer diagnosis in the household cat. This is where cat health insurance comes in. Due to the recent increase in the cost of veterinary services, cat health insurance has turned out to be a crucial choice for most people. In this article, readers will discover the various categories of cat health insurance, things to bear in mind when selecting the policy, and how to maximize their choice to allow their cats to benefit from the best plan.Health Insurance for Cat: A Safety Net for Pet Owners

Description:

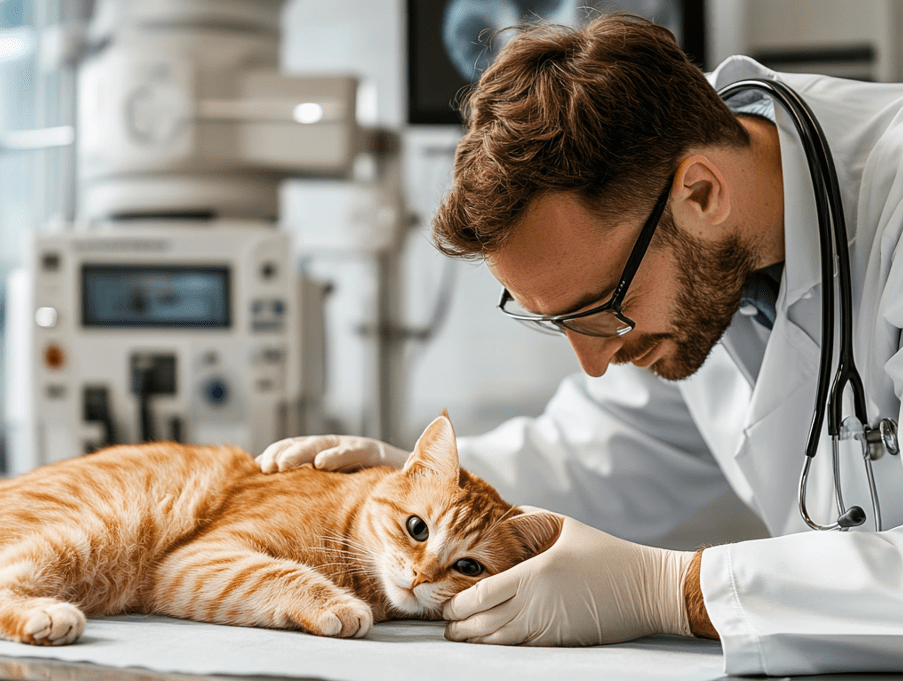

Health insurance for cats offers peace of mind by covering a wide range of medical treatments, from routine care to unexpected emergencies. With the rising costs of veterinary care, having an insurance policy can significantly alleviate financial pressure. Whether you opt for accident-only coverage or comprehensive plans, health insurance ensures that your cat receives prompt and quality care when needed. Policies vary, so it’s important to choose one that aligns with your cat’s needs, providing coverage for potential health issues based on their age and breed.

Kitten Health Insurance: Early Coverage for a Healthy Start

When it comes to kitten health insurance, starting coverage early can prevent costly vet bills down the road. Kittens are typically healthier than adult cats, meaning their premiums are usually lower. However, ensuring that your kitten has health insurance from an early age can safeguard against unexpected injuries and illnesses. Early coverage can also provide preventive care like vaccinations, flea treatments, and spay/neuter procedures. Choosing the right policy for your kitten ensures a strong foundation for their long-term health and reduces financial strain if medical issues arise later.

Understanding Cat Health Insurance: Key Considerations for Pet Owners

Cat health insurance is becoming an essential aspect of responsible pet ownership. By providing financial protection against veterinary expenses, it ensures that your cat receives the best care without the burden of high out-of-pocket costs. Depending on the policy, coverage can include everything from accident and illness treatment to preventive care and wellness exams. When choosing a policy, it’s important to consider your cat’s health history, breed, and any potential risks associated with their age. The right health insurance plan can make a significant difference in your pet’s well-being and your peace of mind.

Why Consider Cat Health Insurance?

Peace of Mind

Cat health insurance means that in case of a disease or a veterinary emergency, you will not have to sacrifice your money or your cat’s health. Insurance will allow for the costs of treatment for illnesses, injuries, or emergencies, that may occur to you at one point.

Access to Better Care

Insurance lets you find the best treatment for your cat disregarding the price tag that usually comes with it. It can help you have the freedom to go normal or seek veterinary practice and treatments you would probably not be able to afford.

Preventive Care Coverage

Current insurance policies for pets allow for scheduled or preventive checkups for your cats including vaccinations, flea treatments, and annual check-ups.

Financial Protection

Medical checks and treatment in animals such as operations or cases of pinned diseases cost a lot of cash. Insurance covers those big and unforeseen expenses and guarantees the treatment for your cat.

Different Categories of Cat Health Insurance Policy

Accident-Only Coverage

This type of insurance only pays for accidents like falls, poison ingestion, A hit by a car, and the like. It is suitable for those cats that rarely suffer from chronic diseases or conditions throughout their lives. Nevertheless, it does not include disease treatment or annual checkups.

Comprehensive Coverage

Accompanied, or broadly speaking, “accident and illness”, is the most widely-chosen type of protection. Both accidental injuries and sicknesses are included such as operations, hospitalizations, and prescription drugs, treatments for chronic diseases like diabetes or renal failure. It offers very comprehensive coverage for pet owners to ensure they are comfortable with any type of health situation.

Preventive/Wellness Coverage

Some of them have or provide a preventive care package that has vaccinations, spay or neuter, and other optional services like dental polishing, flea treatments, etc. Although not compulsory for all customers, it provides services beneficial for those with a pet that requires constant care for their cats.

Emergency and Specialty Rates

This plan entails expensive procedures such as operation, treatment of cancer, or a visit specialist. This may be ideal depending on the breed of your cat; if you’re likely to be dealing with serious health issues or in a region that calls for specialists.

Medical Insurance for Cats: Comprehensive Coverage for All Health Needs

Medical insurance for cats provides comprehensive coverage for both routine and emergency care. This type of policy can cover a wide range of medical expenses, including surgeries, treatments for chronic conditions like diabetes, and hospitalizations. With medical insurance, pet owners don’t have to hesitate to seek the best care when their cat becomes ill. It can also cover specialty care, ensuring that you have access to top-tier veterinary professionals, even if your cat requires more complex treatments or surgeries.

Some Things You need to consider When Selecting the Plan

Age of Your Cat

Cats’ age heavily determines the cost and the kind of insurance policy you should acquire for your cat. You often see that young cats with fewer health issues have less expensive premiums compared to older cats who may have conditions before signing up.

Breed-Specific Health Risks

Some strains of the breed have inherent diseases, for instance, destructive hip dysplasia in Maine Coons or heart disease in Persians. One should ensure that a plan they are to choose provides coverage for all conditions related to the breed in question.

Deductibles and Copayments

As for the parameters of the financial risk niche, each policy includes various options of deductible and copayment. In some plans, the cost of insurance is high, but the amount to be paid at the beginning of the year is low, while in other plans, the cost of insurance is low together with the amount to be paid at the beginning of the year but the monthly premiums are high. It becomes easier to decide based on the costs that are explained in this paper.

Reimbursement Limits

There can not only be annual limits to the amount that an insurance policy will contribute towards claims but per condition too. Make sure to check on these limits because that way, you will be able to see whether your cat’s policy will cater to all his/her requirements or if you are likely to have to spend a fortune on him/her.

Exclusions and Limitations

Be cautious while reading the policy as it defines the unprecedented situations where(float) Illustrations of the general exclusions are pre-existing conditions, congenital diseases and conditions, and cosmetic surgeries. They may also contain policy exclusions based on the breed of the dog, meaning it will be important to know what exactly is included and excluded.

Customer feedback and credibility

Check online forums and complaints sections on their platform to evaluate their customer treatment and compensation procedures. Search for insurance companies with fast claim services and no hidden charges.

Recommended Cat Health Insurance Companies

There are some excellent cat health insurance products on the market from quite a few insurers. Here are some of the top providers:

Healthy Paws Pet Insurance

Claimed to offer pension-like benefits, Healthy Paws has a high annual and lifetime limit of $100 per incident. They have reported a simple claims process with high customer satisfaction on customers’ service.

Trupanion

Trupanion also presents policy with a clear per-condition deductible – this means that once the cat has reached a particular amount of the deductible for one or another condition, all future claims can be made with 100% confidence.

Pets Best

Pet’s Best also offers a wide variety of acceptable products for low prices. They also provide so-called ‘additional wellness plans’ to participate that would cover preventive measures.

Figo Pet Insurance

Figo has variable packages which some of them include the accident-only plan and the comprehensive policy. Further, they have a smart and efficient application of claim processing and your health record too.

Embrace Pet Insurance

Embrace namely offers set packages with different choices of wellness care and a decreasing-deductible plan, which is the amount you have to pay out-of-pocket and then have insurance cover before the insurance company does not reduce your deductible over some period when you are not making claims.

How much does Cat Health Insurance cost?

As with any form of insurance, the cost of cat health insurance depends on several things such as your cat’s age, breed, and where you live. For a healthy cat, it will cost between $15 and $60 per month for their premium. Kittens and cats, that have not been to the vet, may attract lower costs, while older cats and those with some comorbidities cost more.

Some carriers reduce the price for ensuring several pets at once or if you decide to buy an annual policy instead of a monthly one. Even though having insurance may feel out of the ordinary and costly, just like with all your cat’s basic needs, the rewards you’ll receive should your cat get seriously ill would be highly beneficial and so would be the extra bucks paid.

Some may wonder about cat health insurance alternatives to traditional insurance

If traditional insurance isn’t the right fit for you, there are alternatives:

Pet Savings Accounts

It is possible to open a separate bank account for the eventualities of financing your veterinary needs to save for some time before paying cash.

Veterinary Care Credit Cards

CareCredit, for instance, is a payment option that the vet offers you so that you can pay for the services in installments.

Discount Programs and Clinics

What some clinics have is that they have a discounted price for its members or people who joined their clinic for a marketing campaign which they avail for their first visit ever and a cheaper price for general grooming and some particular treatments.

Filing Your Claim and Know Your Policy

1.Applying for a claim usually requires filling in an application form supported by the veterinarian’s bills and documentation. The insurer will consider the claim and you will be compensated according to your plan choice. Please remember to adhere to the following procedures as dictated by your insurance company so as not to be shut down.

2.It is crucial to have full knowledge of your policy so that none of the terms work against you once you are in a position where you need to clarify. There are always these three points in any health cover policy: What is included in the policy, how is the amount going to be paid back, and what is not allowed?

Conclusion

Cat health insurance refers to such plans that are rather useful to enable the cat’s owner to cope with the health issues of a cat without worrying about the expenses of treatment. By looking at the various types of coverage you are in a better position to analyze your cat’s needs and come up with the right insurance plan. Step up to compare the cost, coverage, and reputation of the provider so that your cat may get the best treatment when it is sick.

Additional Resources

To get more specifics on cat insurance and the best coverage for your kitty’s health contingency plan, kindly check the websites of the best insurance companies listed above. This also provides more links to follow on pet care, disease risks involving each breed, and tips on having a pet medical expenses plan.